We Help Homeowners With Property Damage Navigate The Insurance Claims Process For Max Payout

Claims And Appraisers Public Adjusting

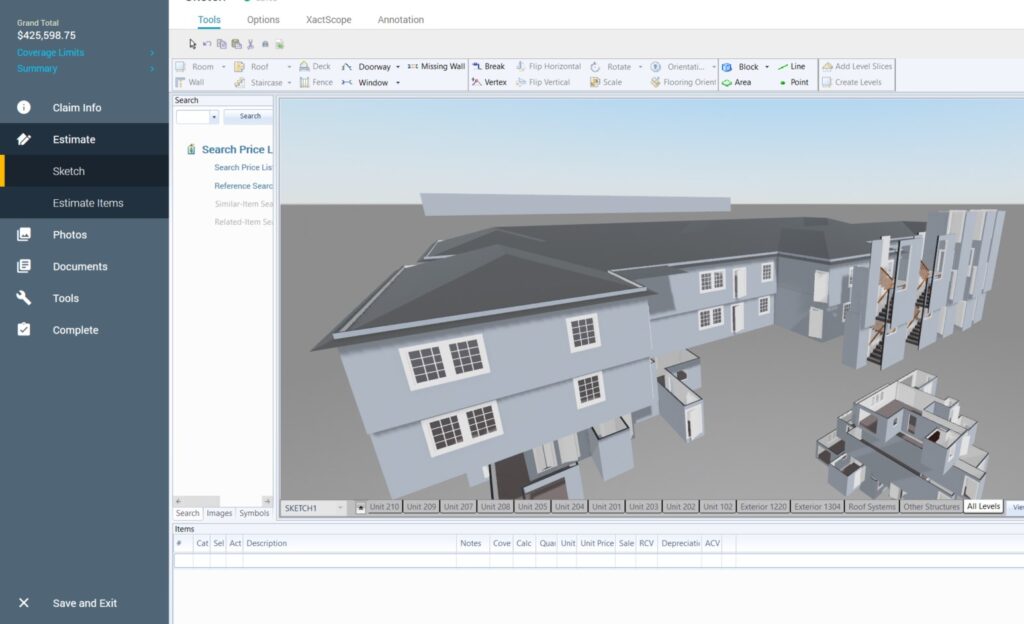

We Help Homeowners Get the Insurance Payout They Deserve

Roof leaks, water damage, fire, vandalism — if your home is damaged, we fight to get you the money you’re owed.

Your Advocate in the Insurance Claims Process

At Claims and Appraisers, we work for homeowners — not insurance companies. With thousands of claims handled and years of experience on the inside of the insurance industry, we know exactly how carriers operate and how to challenge their tactics. Whether your property has been damaged by fire, water, storms, or other disasters, our mission is to secure the maximum settlement you deserve.

From free inspections to policy reviews and full claim negotiations, we’re with you every step of the way — and you never pay us until you get paid.

What Makes The Claims Process

So Complicated & Stressful

Claim Denials

Policyholders frequently complain about their claims being denied, often due to technicalities or exclusions in the policy.

Low Settlement Offers

Many homeowners feel that the settlement offers they receive from their insurance company are too low to cover the actual damages and repair costs.

Customer Service

Poor customer service experiences, including difficulty reaching representatives and receiving unhelpful responses, are common complaints.

Slow Claims Process & Poor Communication

Delays in the claims process, from initial reporting to final settlement, are a major frustration for many policyholders. A lack of clear and timely communication from insurance companies often leave homeowners feeling anxious about their claims.

Complex Policy Language

The technical and legal language used in insurance policies can be difficult for homeowners to understand, leading to misunderstandings about coverage and exclusions.

Disputes Over Damage Assessment

Disagreements between the homeowner and the insurance company over the extent and cause of the damage can lead to dissatisfaction.

Our Services – We Work for You, Not the Insurance Company

This is a solicitation for business. If you have had a claim for insured property loss or damage and you are satisfied with the payment by your insurer, you may disregard this advertisement

Fire Damage

Fire can cause devastating loss, from structural damage to smoke contamination. We assess all damage, review your policy, and ensure nothing is overlooked in your claim.

Roof Damage

Storms, wind, or falling debris can compromise your roof’s integrity. We document the damage and negotiate for the full repair or replacement cost you’re entitled to.

Flood Damage

Flooding can lead to severe structural and mold issues. We help you navigate complex flood coverage rules to get the maximum settlement possible.

Wind / Hurricane Damage

High winds can rip off roofs, damage siding, and shatter windows. We ensure all visible and hidden damages are included in your claim.

Mold

Mold spreads quickly and can harm both your property and health. We work to ensure your policy covers the necessary remediation and repairs.

Plumbing / Leak

Pipe bursts and leaks can cause costly water damage. We document the full scope of the loss to prevent your insurance from underpaying.

How Do We Help You?

After a loss, we review your homeowner’s insurance policy to determine what you are entitled to, as apposed to what your insurance says they’re covering. Then we review the estimate prepared by your insurance to see where you might have been underpaid.

First Way We Can Help

Handle Your Claim From The Start

Document The Loss & Prepare An Estimate

Work With Your Insurance To Negotiate The Largest Settlement We Can For You

Second Way We Can Help

Come In After Your Carrier Has Made A Coverage Determination

Review Your Policy & The Insurance Estimate

Advocate For What You’re Entitled To

Present My Estimate To Your Carrier

Work With Your Insurance To Reach A Settlement

Why You Should Never Let Doubters Stop You!

Building Trust - Felix Herrera Interview

Miramar Pembroke Pines Chamber of Commerce

Kind of a Big Deal | Business Entrepreneur Podcast | Insights Tips & Stories

In this episode of Kind of a Big Deal, we sit down with Felix Herrera, a licensed public adjuster and founder of Claims & Appraisers Public Adjusting. Felix shares his journey from working for insurance companies to becoming a trusted advocate for homeowners — and the secrets behind building a business that runs on referrals, trust, and integrity.

Frequently Asked Questions

What does a public adjuster do?

A public adjuster works exclusively for you, the policyholder — not the insurance company. We assess your property damage, review your policy, and negotiate the highest possible settlement on your behalf.

How much do your services cost?

We work on a contingency basis, meaning we don’t get paid unless you do. Our fee is a small percentage of your settlement, and our inspection & consultation are always free.

When should I call a public adjuster?

The sooner, the better. We can help from the start of your claim to avoid mistakes, but we can also step in if your claim has been denied, delayed, or underpaid.

Can you help if my insurance company already made an offer?

Yes. We can review their estimate to see if damages were overlooked or undervalued and fight to get you the additional amount you’re entitled to.

What types of claims do you handle?

We handle fire, flood, roof damage, mold, wind/hurricane damage, plumbing leaks, structural collapse, vehicle impact, vandalism, and more.

How long does the claims process take?

It depends on the complexity of your claim and how quickly the insurance company responds. We work diligently to move the process along and keep you updated every step of the way.

Do I have to pay anything upfront?

No. There are no upfront costs. You only pay us after your claim is settled and you’ve received payment from your insurance company.

Will hiring a public adjuster upset my insurance company?

No. It’s your legal right to hire a licensed public adjuster. In fact, having a professional on your side can lead to a fairer and faster resolution.

Our Happy Clients!

He worked so hard for us after getting the run around from our insurance company. He never stopped fighting to make sure we got our policies contractual amount. Super appreciative we found Felix.

I met Mr Felix Herrera thru my son in love Jean. His professionalism and courtesy make a big difference from the others and I appreciate him very much.

Felix was great and helped me through the process that can be very overwhelming.

Felix was great, very detailed and communicated every step of the way. Highly recommended 👍🏽👍🏽

Hello, I hired Felix to be my public adjuster after the hurricane in 2022. He did outstanding job handling my insurance claim and getting in done in a reasonable time. He’s a pleasure to work with. Highly recommend Felix!

Felix was an amazing adjuster. I had a claim on a rental property 1 month before I had a house fire on another home of mine. The second home with the house fire I used Felix. I was paid out way faster with Felix and the 1st home was still pending….. he worked so well, that I used him for another claim i had a few months later another rental. I highly recommend. As an investor I’ve worked with many adjusters, and can safely say I’ll be using Felix again if needed

I contacted Felix with ceiling damages caused by a leak from my guest bathroom, he worked with my insurance and their adjuster and facilitated a new bathroom. I will forever be grateful for Felix Herrera and his professional demeanor and caring nature.

Don’t Just Let the Insurance Company Decide What You’re Owed

If your home has suffered damage, you deserve a fair settlement — not a lowball offer. Our licensed public adjusters fight for every dollar you’re entitled to. No fees until you get paid.

We Help Homeowners With Property Damage Claims & Make Sure Their Insurance Doesn’t Under Pay

FOLLOW US

Company

Claim Types

© 2026. Claims And Appraisers LLC . All Rights Reserved.